When my husband and I moved out of state away from our family, we knew that it was time to add a travel credit card to our lives so that we could rack up points and cash in free flights to go back and visit. After tons of research on all of the different options out there, we decided on the Chase Sapphire Preferred Card and it was easily one of the best financial decisions we ever made. My only regret is not signing up sooner and that’s why I’ve decided to put this easy guide together to hopefully answer some questions you might have if you’re looking into a travel credit card yourself.

One thing I want to note before diving in is that a travel points credit card like this might not be the best option for your family. Before diving into a financial decision like this, I would advise focusing on setting up a solid budget system first. Set parameters for your spending and find a system that works best to keep you disciplined and wise in your financial decisions. Signing up for a credit card doesn’t have to be scary, but it does require some preparation and financial decision making first!

*Disclaimer: This post is NOT sponsored, but the links presented are referral links that will give me bonus points through my Chase Sapphire account. The best part is you get bonus points, too! You may also access my advertising policy here.

Chase Sapphire Preferred Card: What is it?

I am going to try and keep this simple but you can review full details on the card’s terms here. Basically every purchase you make using the Chase Sapphire Preferred credit card produces points that you can keep track of in your personalized Chase Rewards portal. Some purchases like dining, streaming services and online groceries can get you up to three times the number of points, but for the most part you will consistently rack up points as you use the card. The more purchases, the more points you will earn!

The points you earn from purchases will show up in 1-2 billing cycles on your Chase account dashboard. Once you open the credit card account, you will have access to a reward redemption portal that lets you exchange points for a variety of things including plane tickets, hotel stays, rental cars, cruises, cashback/statement credits and more! I will go into more detail on this below.

TIP: You can earn 60,000 bonus points just for simply signing up! Use this link here to sign up and get your bonus points. There is a purchase requirement within the first 3 months to meet this bonus but it’s super easy to do and so worth it!

Why the Chase Sapphire Preferred Card is Best

Almost every travel website I could find rated this credit card as one of the top cards for travel benefits. And I would have to agree with that from what I could find in researching all of the many options out there. The points seem to go a much longer way than any other credit card and can be used for a wider range of options as well. A few years ago, I had signed up for a United Airlines credit card thinking it would be worth it to rack up points directly through an airline. Well, it ended up being rather difficult to earn enough points in a good amount of time and I hated being restricted to just one airline for redeeming points through. For this reason alone, I think the Chase Sapphire Preferred card is worth it, since you have access to a number of different airlines.

But it goes even beyond this with the ability to redeem points for stays at hundreds of hotels across the globe and the ability to even transfer points to participating travel partners (such as Southwest, Marriot Bonvoy, World of Hyatt and more)! The possibilities are so great with this credit card, making it one of the best ways to basically get “free” money just by using a credit card.

A few terms to highlight:

- The 60,000 point sign-up bonus is contingent on spending at least $4,000 on purchases in the first 3 months of the account opening. (60k points amounts to about $750 towards travel when redeeming through the Chase Ultimate Rewards portal)

- There is a $95 Annual Fee charged every year for the card. This is one of the lowest fees I have personally seen charged by a credit card company!

- There are NO blackout dates or travel restrictions when redeeming points through the Chase Ultimate Rewards portal. As long as there is a seat on the flight or a room available at the hotel, you can book it using points!

- My Chase Plan: Chase offers the ability for eligible cardmembers to break up card purchases of more than $100 into fixed monthly payments with something called “My Chase Plan.” This means no interest, just a fixed monthly fee! This is something I found to be super unique to the Chase Sapphire Preferred card!

- There is SO much more that this card has to offer but these were a few of the highlights that I found to make this card unique. Browse all of the many other terms and offers that this card brings here and keep reading more info on how to redeem points and our personal experience!

Now let’s get into exactly how you can use your points and what some of my favorite features are!

How to Use Points

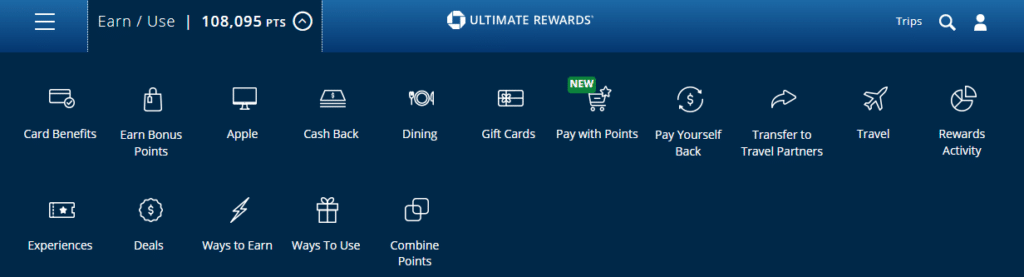

Every time you login to your Chase account, you will have access to your points and the Ultimate Chase Rewards Redemption portal. This is the same dashboard you will pay your bill and download bank statements from. On the right-hand side of the screen, there will be a place to click that takes you to the points redemption portal where you can browse all of the many ways points can be used.

Here is a screenshot of the portal drop-down tab that offers all the resources for earning and using your points. Here you can review your card benefits, find ways to earn bonus points and redeem your points.

There are a few different ways you can redeem points for travel:

1. Through the Chase Ultimate Rewards Redemption Portal Directly

This is personally my favorite way to redeem points because it’s super easy to use and your points go SO far booking through the Chase Ultimate Rewards portal. All you do is click the travel tab, search for a flight or hotel room and browse the many options for point redemption. Just like booking a trip normally, some days are more expensive to travel so you will need to spend some time altering your searches to find dates that will get you the most use out of your points. You can also redeem points for rental cars, destination excursions and cruises!

The prices really do depend on the time of the year you plan to travel and your destination, but let’s walk through a mock up example:

Trip Option: LAX (Los Angeles) – JFK (New York) trip for 2 for 5 days in May

Flight: American Airlines (1 stop), roundtrip = 17,935 points X2 = 35,870 points

Hotel: 4-Star Hotel (4 nights) = 71,328 points

Total Trip: 107,198 points

Assuming you signup today, qualify for the 60,000 bonus points and use the card regularly, you could have enough points in just a few short months to cash in a trip like this!

For the demonstration above, I chose a domestic location that would be pricier to show you the high-end of redeeming points. International flights would be a little bit more per person, but hotels are pretty comparable in some of the most popular European countries that I have searched! I go into further detail on a personal experience of ours below that only needed about 90,000 points for a 5-day trip, so I would estimate that 90,000-120,000 points is a good starting range for a solid trip covered by points!

2. Transferring Points to Travel Partners

Chase Ultimate Rewards points transfer 1:1 to participating partners such as Southwest, Marriot Bonvoy, World of Hyatt and more! Let’s say you have 25,000 Chase points and want to transfer them to your World of Hyatt account. The transfer is the same point to point value meaning you could cash in those points for 25,000 Hyatt Points.

You can also transfer points to participating airlines. This is great because it’s almost like having an airline credit card for a handful of airlines instead of just one!

3. Paying Yourself Back

You can also cash-in your points for a statement credit. Your points do go further if you redeem them on travel or transfer to a travel partner instead, but this is always an option for things you can’t redeem directly through the Chase portal. The cashback option is easy to calculate. Every 100 points = $1.00. So if you have 100,000 points, you will have $1,000.00 to redeem as cashback on your credit card statement!

This means that if you were to signup today and qualify for the 60k points signup bonus, you would have enough to cash out $600 in just a few months! That’s crazy!

Chase also offers occasional cashback deals on certain categories such as Airbnb purchases through the “pay yourself back” tab. Since you can’t redeem a stay through Airbnb directly through the Chase portal, this is a way to maximize points for stays you book directly through Airbnb.com! For example, one time my husband and I booked an Airbnb stay that amounted to $485.68. We used our Chase Sapphire Preferred card to pay for the stay and were then able to redeem only 38,854 points to completely cover the cost of the stay! Typically 38,854 points would only equal $385.40 in value, but because Chase partners with Airbnb in this way, you get 25% more value by using your card and redeeming points later to cover the purchase!

There is also a way to “pay with points” through certain merchants like Amazon and PayPal. I personally have not used this service but from what I can gather, every 100 points equals about $0.80 when shopping this way. So let’s say you have an Amazon cart full of stuff for $50, you could essentially use 6,250 in points to cover that purchase. I personally don’t think this is the best way to redeem points but it is an option if you need that!

NOTE: Don’t forget that you can get 60,000 bonus points just for simply signing up! Use the link below to signup & get your points.

Our Personal Experience with the Chase Sapphire Preferred Card

To wrap up this post, I wanted to share our first experience with redeeming points for a 5-day stay in Orlando, Florida during a peak season in September. It took us about five months of consistently using the credit card to rack up enough points for this trip. To be candid, we use our Chase Sapphire Preferred card for everything. We treat it like a debit card (which I go into more detail on in this post here) so that almost every purchase we make on a daily basis puts points in our account and money back into our pockets!

Once we had enough points, we used the rewards portal to book our flights and a 4-star hotel. The total amount of points we used for this trip amounted to 96,400 BUT we made a pit stop in Los Angeles first, so this technically covered flights from Omaha to Los Angeles, to Florida and then home. Plus, the 4 night stay at a hotel in Orlando. On this trip, we ended up going to Walt Disneyworld for 4 days. We very well could have covered our Disney tickets by utilizing the statement credit option with some leftover points but we opted out of that to save them for the future.

It’s been 6 months since that trip and we already have enough points to go on another trip like this! At this rate, we can cash in points every 6 months for bigger trips like this OR flights to go back home and visit family ever 2-3 months! As you can see, I 100% believe this card is worth the hype. It is easy to rack up points and there are so many incredible ways to redeem those points once ready. I only wish we had signed up earlier!

That completes my easy guide to the Chase Sapphire Preferred card. I hope you found this helpful in your decision making! If you have any questions at all, feel free to drop them in the comments below and don’t forget to check out my 5 Tips for Traveling on a Budget if you are looking for more affordable hacks. Happy traveling!

p.s. please note that some of the terms outlined in this post may be different at the time you are reading this. Please refer to the Chase Sapphire Preferred official website for updated information.

PIN IT: