Learning how to budget your money is HARD, folks. Especially as a beginner with no idea where to start! I’m spilling the secrets on budgeting for beginners so that YOU can take the necessary steps to achieve true “financial peace!”

I also need to start by saying, I am in no means an expert on budgeting and handling money but one of the greatest blessings my husband and I have come to recognize about our marriage structure is that we have always stuck to a consistent budget plan and structure. And friends, it really does work.

I hope these inspire you, and maybe even help you free from the shackles of debt. Lets dive right in!

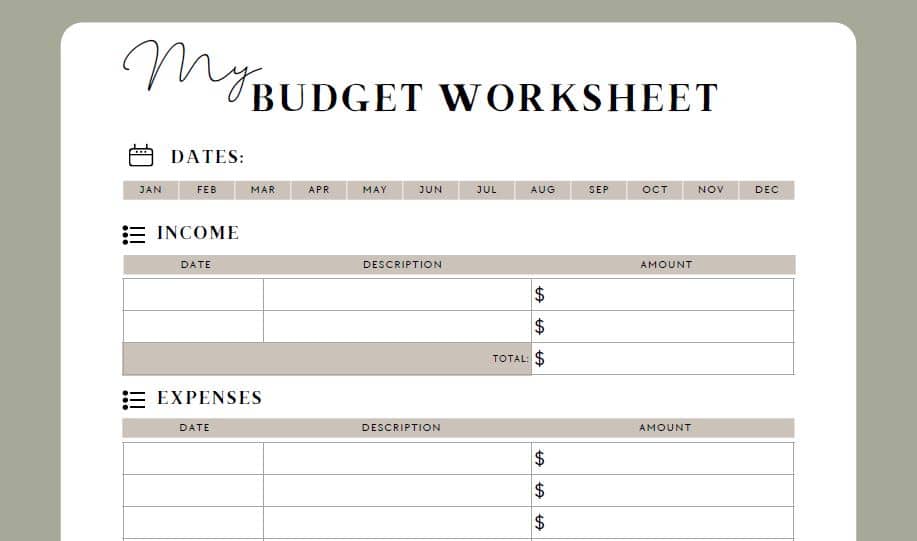

Build a Budget Worksheet

This is a really good place to start. AND I’ve even got you covered for this part (you’re welcome). Just fill out your email below and get the printable template sent straight to your inbox, no strings attached!

If you decide to make your own, you need to make sure that your worksheet outlines every single bill you have for the month, with its corresponding due date. This way, when you come together to talk about your money, you can visually see where everything is going, when payments are being made, and how much you need to have delegated to specific categories so that nothing ever slips between the cracks.

This budget worksheet will look differently for everyone once you’ve entered all the details, but the first step is developing a plan so that you can visually outline your money each month. This is important, because you can refer to the worksheet throughout the month to keep track of what is being spent and what you had budgeted for in the first place.

Here is a sneak peek:

Budget at Least Twice a Month

This may seem like a lot, but it is important. I recommend carving out a good chunk of time to sit down and focus on your finances at least twice a month. If you get paid weekly, it may be beneficial to do this more frequently. If you are married, this is a good time to talk about future goals, game plans, and upcoming events that need to be saved for. It is crucial that you do this twice a month, even if you only get paid once a month, because you want to be proactive about handling your money. If you go too long, you will forget how much you set aside for certain things, and will most likely end up spending more than you had originally budgeted for.

Twice a month will also help you gain better control and achieve a higher level of piece, knowing where every dollar is going and staying on top of that. To put this in perspective: I’m sure you have a pretty good idea about what you have going on say this week and the next. But end of the month?Not so sure – things will change, stuff comes up, and if you talk about it ahead of time, you will have the peace of knowing where your money is going and how much you have left.

This also helps make budgeting a habit. We have personally never missed a budget meeting in the 4+ years that we have been married, because we make it a priority to do it consistently!

Utilize a “Zero Based Budget”

If you take away any one piece of advice from this post, I recommend it be this. And I actually can’t take credit for it. We heard this tip from Dave Ramsey’s Financial Peace course (which I highly recommend you check out, as 90% of our principles come from this course) and it is one of the best tips I have ever heard in my entire life. This recommendation emphasizes the importance of having every. single. dollar designated to a specific category, so that by the time you are done allocating your paychecks to bills, savings, etc., you have $0 left.

“…cultivates a habit of wisdom and self-control with your money, which ultimately leads you to financial confidence and freedom“

Let’s break this out…let’s say you have $1,000 in your bank account. You allocate $500 of that for rent (HA, if only), $100 for insurance, $50 for your electric bill, $100 for groceries, $100 for your car payment, and $50 to your credit card bill. This leaves you with $100 left over. Instead of just leaving that there without a purpose, floating around to be spent on something mindlessly, you need to allocate it to some kind of category. Maybe you put half into savings, and the other half you use to treat yourself to something. But whatever you do, every single penny needs to have a purpose. This creates boundaries, so that you are not spending frivolously or beyond your margins. It also cultivates a habit of wisdom and self-control with your money, which ultimately leads you to financial confidence and freedom.

Establish an Emergency Fund

This tip is also stressed by Dave Ramsey, but I have heard it my entire life. Establishing a fund solely dedicated to emergencies only is a huge must. For us, it started with making it to $1,000 in a separate “emergency fund” account that never gets touched except for emergencies (ie. car breaks down and needs repairs, home appliance needs to be replaced, etc). You must discipline yourself to never tap into this until a true emergency presents itself. There have been quite a few times where we’ve been thankful for this fund because our cars broke down or we got a flat tire, and would not have otherwise had the money to afford getting it fixed right away. If you do tap into it, make it a priority to build it up again, so that you always have something there to protect you.

“You must discipline yourself to never tap into this until a true emergency presents itself.”

I know you will be thankful to have this next time you get a flat tire and already have the money saved right there, ready to be used. It takes the stress away from so many situations and helps protect against building up that credit card debt!

Use Your Credit Card Like it’s a Debit Card

Okay time for an unpopular opinion here. The world tells you that the purpose of credit cards is to pay for things you don’t have the money for up front. This is the most dangerous practice a person can make a habit of, because it is the easiest way to slip into debt without even knowing it. I have so many friends and family members with stories of using their credit card “just this once” to buy a new bed, new tires, etc. and then racking up the charges not even knowing how large their debt was getting. Then, when it comes time to pay the bill, the stress sinks in as you realize you don’t have enough to pay it all.

“This is the most dangerous practice a person can make a habit of, because it is the easiest way to slip into debt without even knowing it.”

The solution to avoiding this: only use your credit card for purchases you already set money aside for. A great idea to help with this: open a few separate savings accounts through your bank (the ones that require a $0 balance) and title them each based on specific categories. For example, you may have one account titled “Credit Card,” one titled “Travel Fund” and one titled “Emergency Fund.

Every time you use your credit card, log into your mobile banking app and transfer money from your checking account to that “Credit Card” savings account. Or keep your receipts and make a habit of transferring the funds once per week. This way, when it comes time to pay the bill, you already have the money set aside.

Additionally, anytime your credit card is used, use it for things that you have already agreed to spend money on at your budget meeting. If you don’t have the money for it, WAIT and save up! It’s worth not struggling with credit card debt.

If you are looking for a great credit card that has great rewards to use towards travel and paying yourself back, checkout my in-depth post on the Chase Sapphire Card and why I think it’s the best out there!

That’s a wrap, friends! There are so many great resources and tools out there to help make tackling your finances easy. But I hope these five practical tips help you get a good start! Life’s greatest stress does NOT have to be your money! Let me know below if you find any of these useful, or if you have any other tips you want to share!

PIN IT: